Furniture depreciation percentage

Under the Diminishing Value method the depreciation for each successive year is calculated on the Base Value reduced by the previous years claim amount. Age specific including cots changing tables floor sleeping mattresses high and low feeding chairs and stackable beds 5.

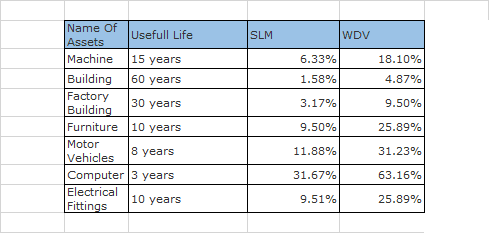

Depreciation Calculator For Companies Act 2013 Taxaj

To calculate depreciation using this method you start by adding the sum of all the years of useful life.

. Gross rent includes both the contract. The type of furniture the condition its in and how long youve had it will all play a role in how much its. Health cost in Goodland Kansas is 107 more expensive than Fawn Creek Kansas.

What percentage of people in poverty lack health insurance coverage in Fawn Creek. 170 rows Class of assets. 5 4 3 2 1 14.

A list of commonly used depreciation rates is given in a. Census Bureau publishes detailed estimates about rental housing in Fawn Creek each year. The information provided herein was obtained and averaged from a variety of.

For 5 years this looks like this. 100 US Average. Since it is depreciated for 10 years the depreciation rate would be 10.

Depreciation refers to the decrease in value of an asset over a period of time. Below 100 means cheaper than the US average. The American Community Survey ACS conducted by the US.

You need to know the full title Guide to depreciating assets 2022 of the publication to use this service. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam. Use our automated self-help publications ordering service at any time.

In 2018 the federal poverty income threshold was 25465 for a family of four with two children and. Then plug this number. Fawn Creek Employment Lawyers handle cases involving employment contracts severance agreements OSHA workers compensation ADA race sex pregnancy national.

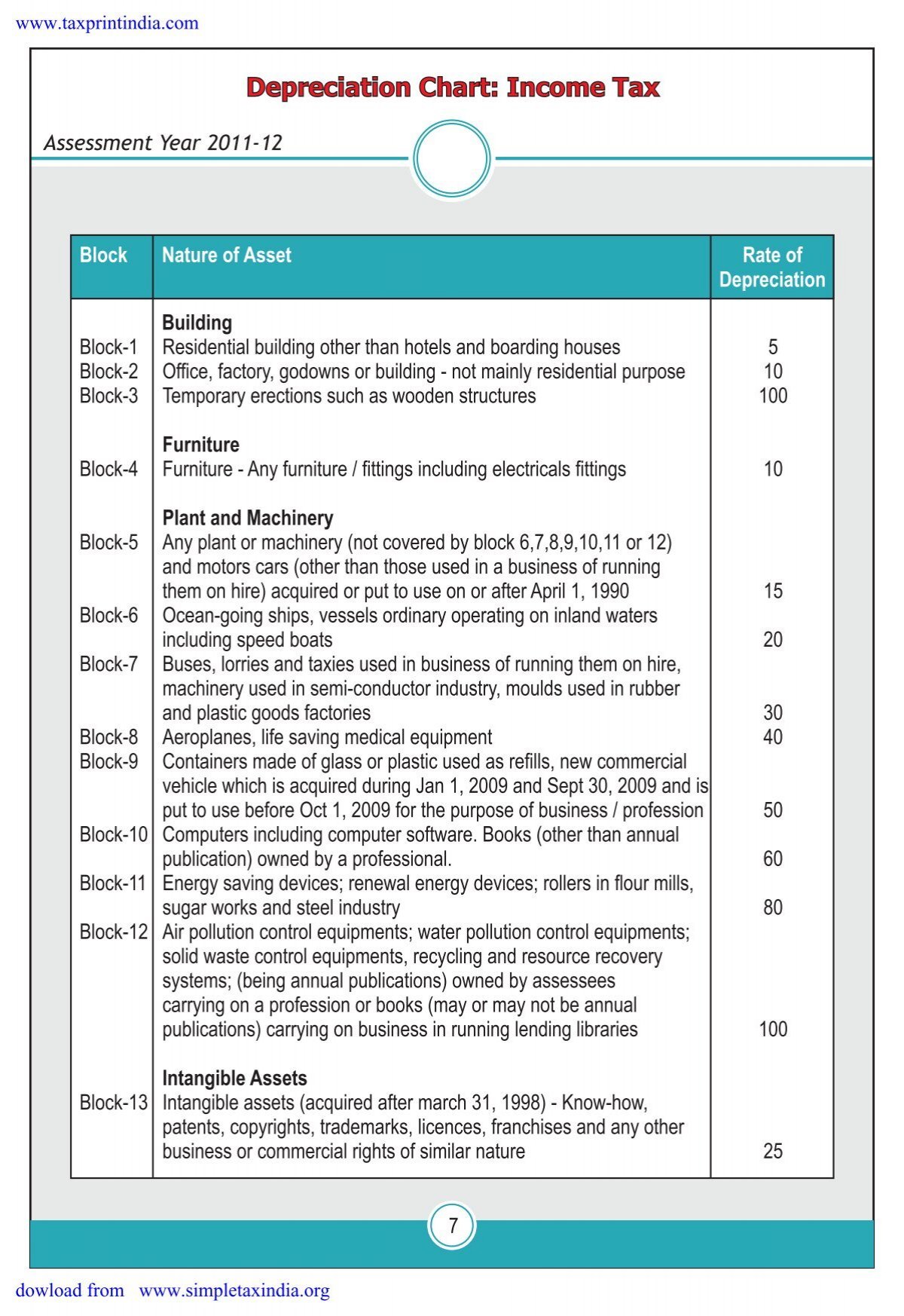

Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below. 59 rows Furniture used by children freestanding. Above 100 means more expensive.

During the computation of gains and profits from profession or business taxpayers are allowed to claim. Year 1 Depreciation 2 x 10 x 1000 Depreciation 20 x 1000 Depreciation 200 After year 1. An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

In general furniture depreciates at a rate of about 15-20 per year.

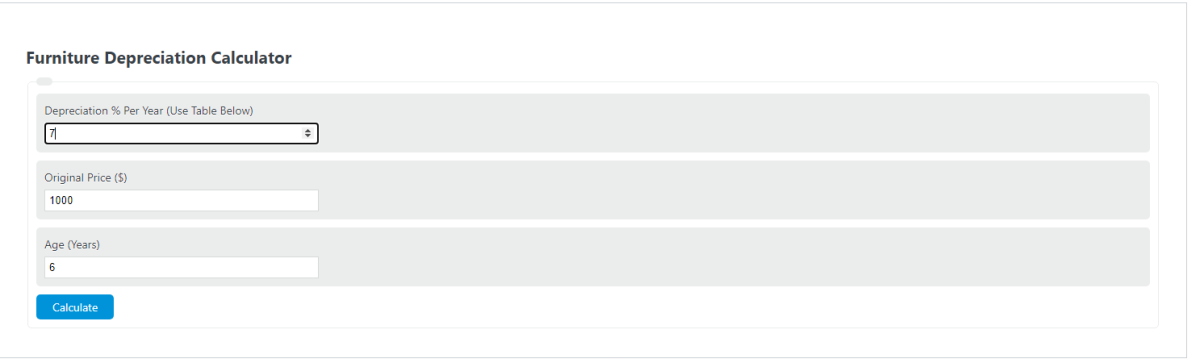

Furniture Depreciation Calculator Calculator Academy

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate For Plant Furniture And Machinery

The Book Value Of Furniture On 1st April 2018 Is Rs 60 000 Half Of This Furniture Is Sold For Youtube

How To Calculate Depreciation Expense For Business

Depreciation Chart Income Tax

Depreciation Formula Calculate Depreciation Expense

Furniture Depreciation Calculator Calculator Academy

Depreciation Of Furniture And Fixtures Download Scientific Diagram

Depreciation Rate Formula Examples How To Calculate

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Depreciation Formula Calculate Depreciation Expense

Depreciation Nonprofit Accounting Basics

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

![]()

Furniture Calculator Splitwise

Manufacturing Special Tools Depreciation Calculation Depreciation Guru

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru