Tax tables 2022 calculator

US Tax Calculator and alter the settings to match your tax return in 2022. This page provides detail of the Federal Tax Tables for 2022 has links to historic Federal Tax Tables which are used within the 2022 Federal Tax Calculator and has supporting links to each set of state.

Effective Tax Rate Formula Calculator Excel Template

The California State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 California State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

. How to use BIR Tax Calculator 2022. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. BIR income tax table.

The Minnesota Department of Revenue is responsible for publishing. On the next page you will be. The first Income tax slab is for individuals under 60 years of age.

The 2022 Tax Calculators are updated with the 2022 tax tables. The California income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2022. Please enter your total monthly salary.

The Idaho State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Idaho State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. South African Revenue Service See your tax rate here including a FREE TAX CALCULATOR. The Michigan State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Michigan State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Calculating income tax in Australia is easy with the. This 80k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Wisconsin State Tax tables for 2022The 80k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Wisconsin is used for. This 35k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Tennessee State Tax tables for 2022The 35k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Tennessee is used for.

Do not use the calculator for 540 2EZ or prior tax years. Detailed California state income tax rates and brackets are available on this page. Click on Calculate button.

We strive for accuracy but cannot guarantee it. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course. NOTE Withholding is calculated based on the New York tables of USA income tax.

CTEC 1040-QE-2662 2022 HRB Tax Group Inc. The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances. For simplification purposes some variables such as marital status and others have been assumed.

The 202223 US Tax Calculator allow you to calculate and estimate your 202223 tax return compare salary packages review salary examples and review tax benefitstax allowances in 202223 based on the 202223 Tax Tables which include the latest Federal income tax rates. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Wyoming State Salary Calculator 2022.

It does not include every available tax credit. Rand Pound 1991. View the most up to date Tax tables of SARS South African Revenue Service See your tax rate here including a FREE TAX CALCULATOR.

Our Tax Calculator uses exact ATO formulas when calculating your salary after income tax. US Tax Calculator and alter the settings to match your tax return in 2022. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation.

The above calculator provides for interest calculation as per Income-tax Act. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. The Singapore Income Tax Calculator is designed for Tax Resident Individuals who wish to calculate their salary and income tax deductions for the 2022 Assessment year The year ending 31 December 2021.

This 75k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Washington State Tax tables for 2022The 75k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Washington is used for. United States Tax Tables and Personal Income Tax Rates and Thresholds. Tax calculator is for 2021 tax year only.

Find your answer online. Updated March 2022. The 2022 India Tax Tables here are used as part of the 2022 India Salary Calculator.

How to calculate income tax in Australia in 2022. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Tax calculator tables rates.

Rand Dollar 1735. Select one of the tax calculators below that reflects how you get paid. The tax tables in India in 2022 are split into 3 seperate age related tables the aim being to reduce the tax paid by individuas as they get older.

The Minnesota State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Minnesota State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The results will be displayed below it. The California Department of Revenue is responsible for publishing the.

Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time. 202223 Tax Refund Calculator. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year.

Form 540 and 540 NR. Individual and HUF Income Tax Slabs 202223. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020.

Federal Income Tax figures so you can review how much tax you have paid in previous tax years or you can use our Salary Tax calculator 202223 to. This calculator is intended to be used for planning purposes. ATO tax withheld calculator or tax tables provided by the Australian Taxation Office ATO which your employer uses to calculate PAYG tax rounds your income and taxes to the nearest whole figure hence you may have some discrepancies with your actual pay on your payslip.

Tax calculator tables rates. All Share J203 66 716. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

The Idaho Department of Revenue is responsible for publishing the latest Idaho State. The Michigan Department of Revenue is responsible for publishing the. Deduct the amount of tax paid from the tax calculation to provide an illustration of.

The annual tax calculator is useful for reviewing annual salaries particularly useful if you are comparing salaries between jobs or a US expat reviewing contract salary rates after tax. Rand Euro 1726. US Tax Calculator and alter the settings to match your tax return in 2022.

You can use our free California income tax calculator to get a good estimate of what your tax liability will be come April. United States Tax Calculator for 202223. The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023.

We can also help you understand some of the key factors that affect your tax return estimate.

Employee Payroll Information Payroll Calculator And Payroll Invoice In 2022 Invoice Template Payroll Federal Income Tax

Sales Tax Calculator

How To Calculate Income Tax In Excel

L9xajm66r9dlnm

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Federal Income Tax

Sales Tax Calculator

Closeup On Desk With Documents For Taxes Calculator And Pen In 2022 Calculator Pen Documents

Excel Formula Income Tax Bracket Calculation Exceljet

Pta Tax Calculator For Import Of Mobile Phones In Pakistan Pta Mobile Phone All Mobile Phones

Donation Calculator Spreadsheet Inspirational Goodwill Values Tax Golagoon Donation Tax Deduction Tax Deductions Spreadsheet Template

Flat Lay Or Top View Of Black Pen With White Calculator On Vivid Yellow Background Table With Blank Copy Space Cost And In 2022 Yellow Background Budgeting Investing

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Us Tax Form 1040 With Calculator Featuring 1040 Tax Form 2015 And Aerial In 2022 Irs Tax Forms Tax Forms Irs

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Bank Notes Earn More Money

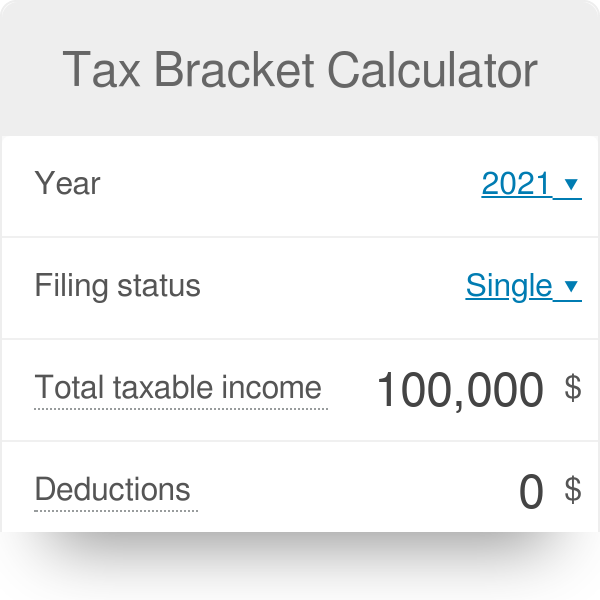

Tax Bracket Calculator

Reverse Sales Tax Calculator